A Tariff Can Best Be Described as:

Does the company Progressive have the best auto insurance rates. April 1 2022 By.

:max_bytes(150000):strip_icc()/TariffsAffectPrices2_2-f9bc0f6dc8f248eb8c6e22ad499b66c0.png)

The Basics Of Tariffs And Trade Barriers

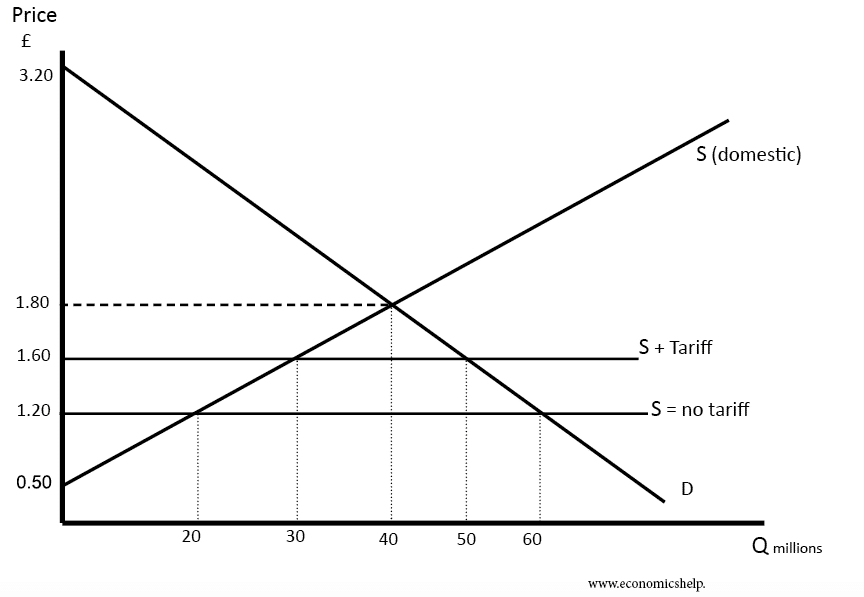

They raise the price of imported goods making imports less competitive.

:max_bytes(150000):strip_icc()/TariffsAffectPrices2_2-f9bc0f6dc8f248eb8c6e22ad499b66c0.png)

. The Republican administrations of the 1920s would best be described as A possessing a foreign policy based on expansion and heavy domestic business regulation B supporting isolationism and laissez-faire business policies domestically C strongly focused on building up the armed forces D open to increased immigration and less stringent quotas. An excise tax on an imported good. An excise tax on an imported good.

For example if foreign companies have to adhere to complex manufacturing laws it can be difficult to trade. A low that sets a limit on the amount of a good that can be imported. A tariff is a tax imposed on imported goods and services.

Tariffs have historically been a tool for governments to. B a government payment to domestic producers to enable them to sell competitively in world markets. These are taxes on certain imports.

An excise tax on an exported good. An excise tax on an exported good. An excise tax on an exported good.

O a law that sets a limit upon the amount of a good that can be imported Ob government payment to domestic producers to enable them to sell competitively in world markets Oc. Import tariffs benefit domestic consumers ceteris paribus. D a law that sets a limit on the amount of a good that can be imported.

A tariff can best be described as. Tariffs give a price advantage to. Law that sets a limit upon the amount of a good that can be imported e.

A either a tax on or a limit on the quantity of an imported good. A tariff is a tax that is imposed by a government on imported or. A tariff can best be described as an.

An ad valorem import tariff is a percentage that is levied on the price of an imported good. Excise tax on an exported good d. A tariff can best be described as.

Progressive is a great insurance company. An excise tax on an exported good. Domestic consumers from foreign competition by lowering the domestic price of the good.

Excise tax on an exported good Od excise tax on an imported good. A tariff can BEST be described as which of the following. A tariff can best be described as.

A law that sets a limit. Tariffs are taxes or duties that are levied on imported goods. A government payment to domestic producers to enable them to sell competitively in world markets.

A government payment to domestic producers to enable them to sell competitively in world markets. An excise tax on an imported good. Prophetic because it came true.

Domestic producers from foreign competition by raising the domestic price of the good. Excise tax on an imported good law that sets a limit on the amount of a good that can be exported excise tax on an exported good government payment to domestic producers to enable them to sell competitively in world markets law that sets a limit upon the amount of a good that can be imported. Tariff can best be described as an.

Excise tax on an exported good d. A quota or protectionism is a government-imposed trade restriction limiting the number or value of goods a nation imports or exports during a specific time. The aim of tariffs are to either raise the prices of imported products to at least the level of current domestic prices or increase revenue for the government.

These involve rules and regulations which make trade more difficult. Law that sets a limit on the amount of a good that can be exported. Government payments to domestic producers to help them compete in world markets D.

A tariff can best be described as A an excise tax on an imported good. A law that sets a limit on the amount of a good that can be imported. A tariff is a type of tax levied by a country on an imported good at the border.

According to the World Trade Organization WTO. A law that sets a limit. A tariff can best be described as.

A depreciation of the rand against other currencies can be useful in the fight against inflation. A tariff can best be described as. A government payment to domestic producers to enable.

An excise tax on an imported good. Up to 256 cash back A tariff can best be described as. Customs duties on merchandise imports are called tariffs.

B either a tax on or a limit on the quantity of an imported good. A government payment to domestic producers to enable them to sell competitively in world markets. A tariff can best be described as.

If you choose not to purchase Chinese goods and instead buy comparable goods made in other nations or. The renaissance can best be described as a gradual change in the way people viewed things. Government payment to domestic producers to enable them to sell competitively in world markets c.

An excise tax on an exported good. A law that sets a limited upon the amount of a good that can be imported. A limit on the amount of imports C.

A tariff can best be described as a n. Government payments to domestic producers to help them compete in world markets D. A tax on an imported good B.

C an excise tax on an exported good. A tariff may be described as a sales or consumption tax the consumer pays but tariffs are also a discretionary and an optional tax. Excise tax on an imported good b.

/TariffsAffectPrices1_2-e3858c9eddb649a8b3ffc70af1f9938b.png)

No comments for "A Tariff Can Best Be Described as:"

Post a Comment